- Conduct comprehensive market research to understand local real estate trends, rental demand, average rental rates, and local rental laws.

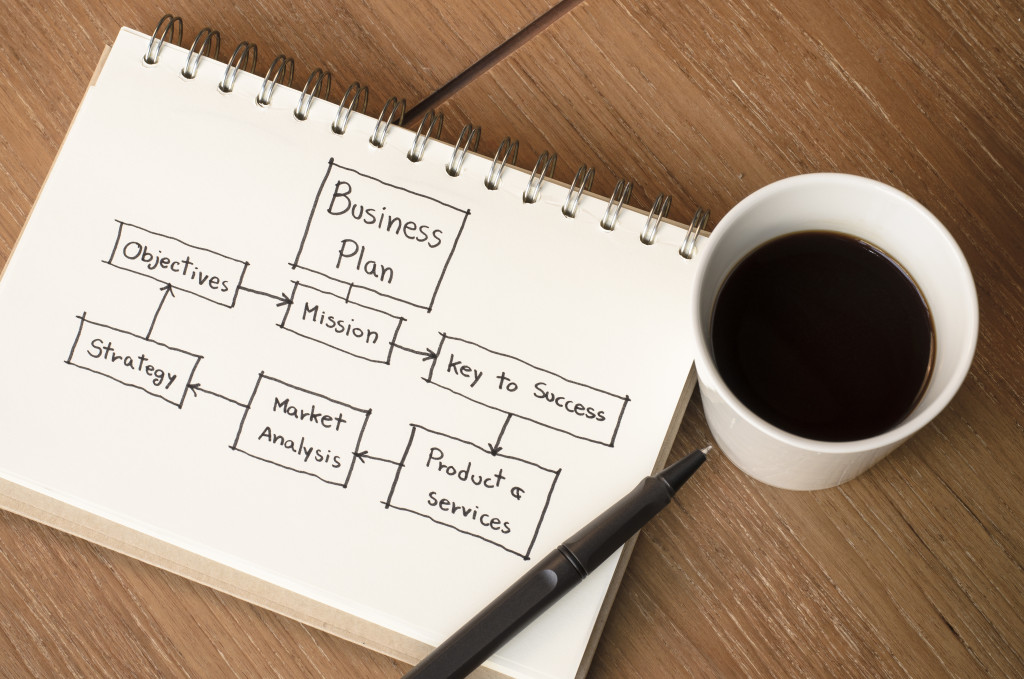

- Create a detailed business plan outlining your goals, strategies, and financial projections, including a marketing plan and financing strategy.

- Identify suitable properties that align with your investment goals and budget, and conduct thorough due diligence.

- Develop a thorough tenant screening process and establish clear lease agreements to ensure a successful landlord-tenant relationship.

- Obtain an Energy Performance Certificate (EPC) for your rental property to comply with legal requirements and attract environmentally conscious tenants.

Starting a rental property business can be a lucrative investment opportunity. It allows you to generate passive income and build wealth over time. However, like any business venture, it requires careful planning and consideration. This guide will discuss five essential tips to help you successfully start a rental property business.

1. Conduct Market Research

Before diving into the rental property business, it is crucial to conduct thorough market research. Understanding the market dynamics and legal obligations will help you make informed decisions and set realistic expectations for your rental property business.

Here are some tips on how to conduct a market research:

Understanding Local Real Estate Market Trends

Gaining insights into local real estate market trends is essential to market research. Look into current home prices, the number of properties listed for sale, and the average time properties stay on the market. These trends indicate the overall health of the real estate market and can help you gauge the potential for rental properties in the area.

Exploring Potential Rental Demand

Identifying potential rental demand requires analyzing various demographic and socioeconomic factors. Consider the area’s population growth, employment rates, and the prevalent age group. Areas with many young professionals or students often have higher rental demand. Also, regions with stable or growing job markets may attract people looking for rental properties.

Assessing Average Rental Rates

Determining the average rental rates in your area of interest is crucial. Look at similar properties and compare their rental prices. This information will help you set competitive rental rates for your properties and calculate potential returns on your investment.

Familiarizing with Local Rental Laws and Regulations

Finally, familiarizing yourself with local rental laws and regulations is necessary for market research. These laws cover various topics, including landlord-tenant rights and responsibilities, eviction procedures, and property maintenance standards. Being well-versed in these areas helps avoid legal issues and fosters a favorable landlord-tenant relationship.

2. Create a Solid Business Plan

A well-crafted business plan is essential for the success of any business, including a rental property business. Outline your goals, strategies, and financial projections in detail. Determine the types of properties you want to invest in, whether residential or commercial and define your target market.

Include a comprehensive marketing plan to attract tenants and ensure a steady rental income stream. Outline your financing strategy, including how to acquire funding for property purchases and renovations if necessary. A solid business plan will serve as a roadmap for your rental property business and help you focus on your objectives.

3. Find Suitable Properties and Perform Due Diligence

Once you have a clear business plan, it’s time to find suitable properties for your rental portfolio. Research and identify properties that align with your investment goals and budget. Consider factors such as location, property condition, potential rental income, and appreciation potential.

Perform thorough due diligence before making any purchase. This includes conducting property inspections to identify any structural or maintenance issues. Review the property’s financial records, including rental history and expenses, to ensure it is a viable investment.

4. Screen Tenants and Establish Lease Agreements

Finding reliable and responsible tenants is crucial for the success of your rental property business. Develop a comprehensive tenant screening process that includes background checks, employment verification, and rental references. This helps ensure that you select financially stable tenants with a good rental history.

Once you have chosen suitable tenants, establish clear lease agreements outlining the terms and conditions of the rental. Include important details such as rental amount, payment schedule, maintenance responsibilities, and any rules or policies specific to your property. Clear and enforceable lease agreements help protect your rights as a landlord and provide a framework for a mutually beneficial landlord-tenant relationship.

5. Consider Energy Efficiency

When managing rental properties, it’s important to consider energy efficiency. Ordering an Energy Performance Certificate (EPC) for your rental properties is legally required in some countries. It provides information about the energy efficiency of a property, helping potential tenants make informed decisions about their energy consumption and costs. Ordering an EPC for your rental property is a legal obligation and demonstrates your commitment to sustainability and energy efficiency.

To obtain an EPC, you must hire a qualified energy assessor to assess the property’s energy performance and issue the certificate. Display the EPC prominently in your rental property and make it available to prospective tenants. Obtaining an EPC creates a greener future and attracts environmentally-conscious tenants.

In Summary

Starting a rental property business requires careful planning, market research, and attention to detail. By conducting thorough market research, creating a solid business plan, finding suitable properties, screening tenants, and ordering an EPC, you can set yourself up for success in the rental property market. Remember, ongoing maintenance, effective property management, and continuous improvement are key factors to ensure profitability and long-term success in the rental property business.